Welcome to the second step of the eight steps framework. Today, I am happy to introduce you to market mapping and the competitive analysis preparation process which is a three steps exercise.

Before we start let me quickly make sure we are on the same page, and paste this market mapping definition (Source)

is a study of various market conditions that is plotted on a map to identify trends and corresponding variables between consumers and products. Mapping can help companies locate problem areas and figure out the source of problems by examining related variables.

Why would a business use a market map?

One of the most notable challenges that every innovator faces is that even when you’re ready and willing to launch a new product, you are quickly faced with the giant, elephant-weight puzzle of deciding where to invest your resources.

The question “What should I consider before I move forward?” is getting more complicated because there are so many factors out there to get into consideration.

Discovering or finding product ideas, choosing the best concepts, and managing their growth and development through to completion are essential innovation management duties.

The ultimate goal is to uncover the most promising high reward, low-risk concepts that will revolutionize the niche, amplify your profits, increase your product launch effectiveness, and sustain your business viability over the long term.

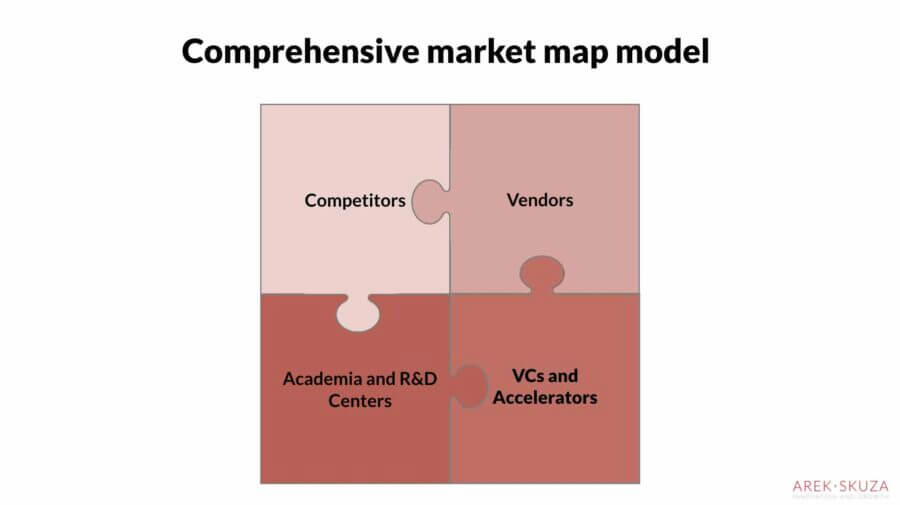

In broad terms, your value proposition and product features should be continuously confronted with the following market players and their offerings:

- Competitors (direct and indirect)

- Vendors

- Academia and Research Centers

- Venture Capitals and Accelerators

Market mapping process in three, comprehensive steps.

The whole process is a three-step process that ensures your map is comprehensive and includes all necessary elements to provide the complete view.

Each step is full of clear tasks, which if you complete, you will get a great document for your further actions.

Step 1 – analyze competitors business models

The first aspect is to scan and understand business models that were scaled successfully and could be considered as benchmarks or competitors.

Exploring and conducting research about all four types of players should provide vital information about working models or those which are about to be launched.

Related: Driving product growth with a business model innovations

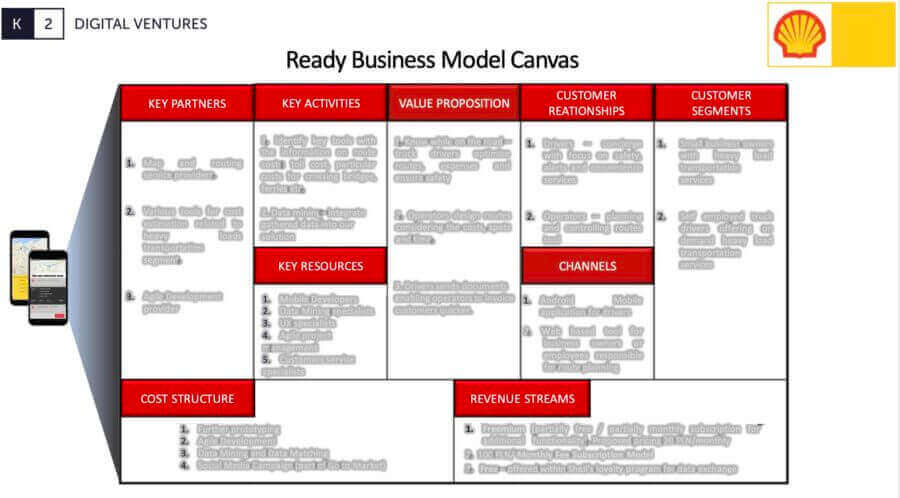

We use the business model canvas (BMC) template for that exercise and we would strongly recommend mapping as many BMCs as possible.

The canvas is an amazing instrument that will help you understand any firm in a straightforward, structured way. It will naturally make your competitive analysis more useful for making further decisions regarding product launch and growth.

For instance, if your company operates the platform which delivers on-demand consulting, like clarity.fm, We think you should run competitors analysis, talk to your vendors to check if your competitors’ list can be extended, scan R&D centers and investors (mostly VC and Accelerators) to get information, and build comprehensive business model canvases.

The model analysis will explain:

- Distribution strategy: Which channels do competitors use to distribute their products?

- Pricing: What they charge (money or data) for the offering?

- Costs: What could be their cost structure? (for instance, if you want to compete with LinkedIn, the business model analysis will tell you that LinkedIn spends significant money on sales representatives).

- Partners: Who your competitors partnered with to deliver the value proposition (it helps you to understand what is your competitors’ product roadmap).

- Apple partnered with Goldman Sachs, and both companies launched the credit card,

- Tesla partnered with Baidu,

- Daimler partnered with What3Works.

- Target customers: well-defined target customers group reflects customers’ pains, which the specific company wants to address and remove. Of you invest time in studying your competitors’ target customers, you can find surprisingly exciting insight.

Here is the excellent example, check this article please, if you’re going to enter the real estate industry with your new product for landlords, you might not know that Bird or Lime (scooter rentals companies) target that group too!

Step 2 – analyze vendors, academia, and investors actions

You could say this “If I scan competitors, and get the comprehensive analysis of their moves, I will be able to adjust my value proposition and prioritize features of my new product.”

We don’t recommend focusing only on competitor analysis, and here is why:

- Vendors are a great source of information about competitors you won’t discover. Moreover, vendors have a relationship with your business, so they are more likely to share and bring you information about potential competitors, which you probably never mapped. I recommend establishing processes of frequent communication with vendors (f.i. workshops, discussions, “what if..” sessions) and share your go-to-market strategy with them. You will engage great, experienced minds into your market landscape analysis.

- Academia and Research Centers are usually working on “the next thing.” If you craft your product strategy, you want to know what they are about to launch, patent, or provide as open-source. You will discover new technologies and features, which can be an opportunity or a threat for your new product/service launch.

- Venture Capitals and Accelerators – this part is pretty simple. Innovators should understand what money follows. Investors make their living by betting on something that will snowball or will deliver significant patents in the future.

By continually scanning all players, not only competitors, you will get more important factors mapped.

Your strategy will consider critical variables, which will make your product positioning map more comprehensive. Now it’s time for the next step.

Once a firm has listed, identified, and screened the mentioned players, the challenge is to position a new product so that it will be launched to the right customer niche.

By “right,” we mean the market/niche spot where are the highest chances to get growth (increase metrics of acquisition, retention, and referrals quickly).

The map demonstrates the range of “positions” that a product/service can take in a market based on variables (dimensions) that are important to target customers (part of the Business Model Canvas, which I mentioned above).

Examples of those dimensions could be:

- Premium price vs. the economy price

- An extensive set of features vs. One feature products

- Necessity (pain killer) vs. luxury (vitamin)

- Modern – traditional

- Long term engagement vs. One time experience

- Low tech-driven vs. High-tech driven

- Global vs. Local

Reach out to Skuza Consulting for thoughtful product strategy and development services.

By learning from a four different types of market players, you will prepare a more advanced and insightful dimensions list.

It will be vital for crafting your competitive landscape analysis because your dimensions list will not be theoretical. Scanning and understanding business models will make a list relevant, properly prioritized, and meaningful.

Dimensions are not features. Features are attributes of something (for instance, Amazon’s one-click buy is a feature while convinience is the dimension)

Step 3 – design the final market map

- List your competitors

- Pin the business models

- Build dimension list and sketch maps

List your competitors. After scanning competitors, working, and communicating with vendors, academia, and investors, simply list them.

We think CBInsight does a fabulous job in listing and selecting (though it’s not necessary) companies. Here is the example of their work

Please use their format. The way they do it, helps to grasp the players quickly.

Pin the business models. We think it’s the most critical step for building a comprehensive understanding of the landscape and mapping the market accurately. If you identified, for example, 50 players on the horizon, and you mapped them the CBInsight style, now the extensive research is required to build 50 BMCs.

Here you can find the BMC me and my team built after scanning Shell Oil and Gas competitors in the logistics niche.

BMCs analysis will give you a lot of ideas for dimensions that are important for your new product’s target customers. The above-attached canvas taught us that drivers love the simplicity and economical price.

Related: Growth depends more on business model than technology

We learned that dimensions like “set of features” and “price” are essential for our end-user. We have also learned that product positioning can’t be a premium price, and an extensive set of features is not welcome.

At the same time, you will learn which dimensions are too competitive (a lot of competitors focus on them).

For instance, if 20 companies provide traditional cooking recipes via their website, this is probably a flag that means “too busy niche.” If your new product wants to take over the “traditional” dimension, it’s probably not a good idea. Your marketing should have a strategy for winning quickly substantial traction in that dimension (for instance, by acquiring a top player).

All of the above, you will learn fast by building business model canvases during your market mapping process.

Building dimension list and sketch maps. A typical map is a two-dimensional graph with a vertical axis and a horizontal axis. Each axis consists of a pair of opposite dimensions at each end. For example, if the map’s purpose is to investigate how users feel about the CRM system, the Y-axis might have “globally scaled” at one end, and “locally accessible” at the other. The X-axis might have “extensive satisfaction” at one end, and “limited satisfaction” at the other end. Each competitor is then plotted on the competitive analysis map based on how users perceive the specific company value proposition.

Conclusion

Continually monitoring competitors encourages you to continue thinking proactively.

By embedding information, not only about competitors but also about other organizations, your market mapping process considers more factors than when you only draft a competitive landscape document.

Using the tools mentioned above can help you systematically gather meaningful data and keep you aware of how you compare with competitors. Armed with this information, you can confidently build a comprehensive landscape for your new product launch.

And if you need expertise for market landscape analysis, contact me.