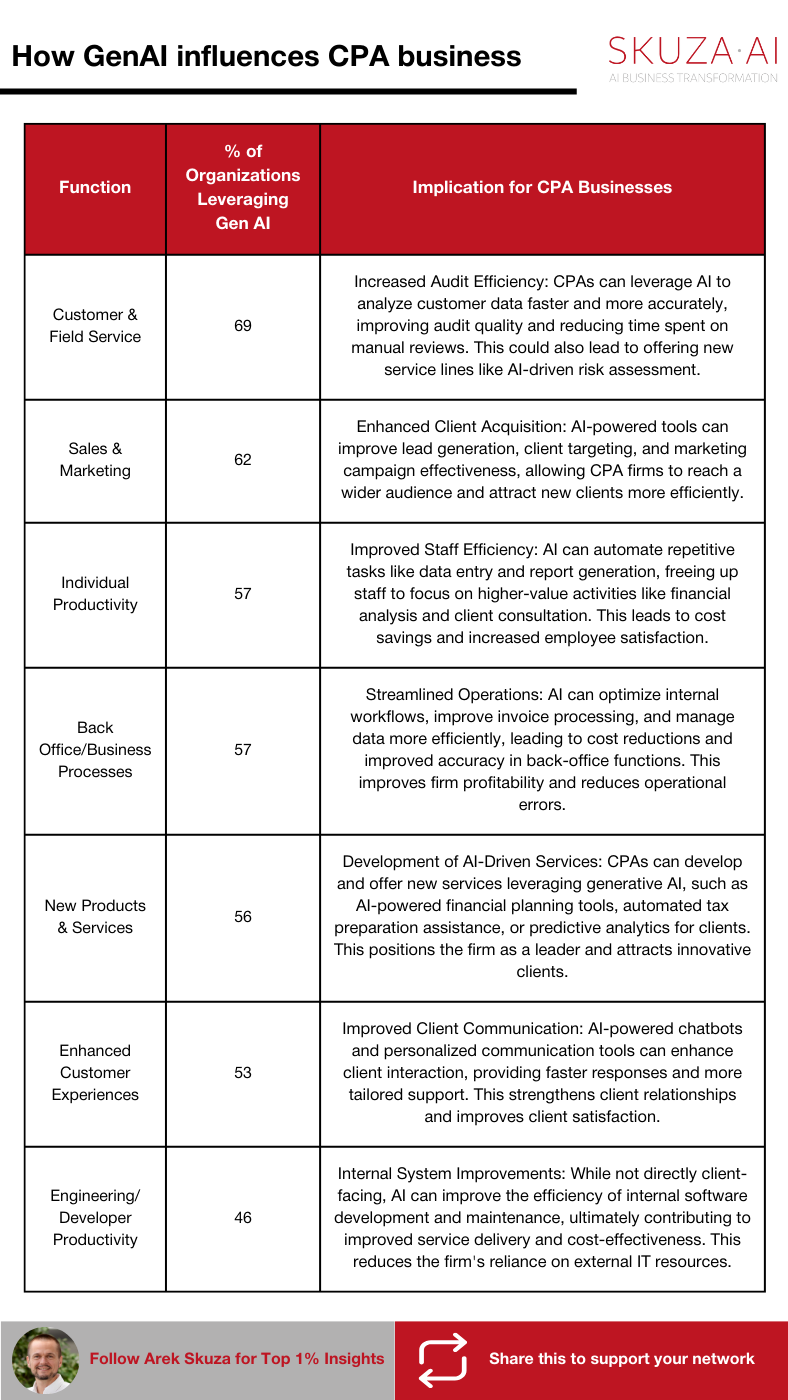

The accounting profession, like many others, is facing significant challenges. From the ever-increasing volume of data and documents to the persistent shortage of skilled labor and the constant pressure to improve productivity and client service, the need for innovative solutions is undeniable. Fortunately, the rapid advancements in artificial intelligence (AI), particularly generative AI and machine learning, offer a powerful arsenal of tools to address these challenges head-on. This blog post will explore practical applications of AI in accounting, focusing on overcoming common hurdles and maximizing efficiency. We’ll move beyond simple tasks like email generation and delve into game-changing strategies that can significantly impact your bottom line.

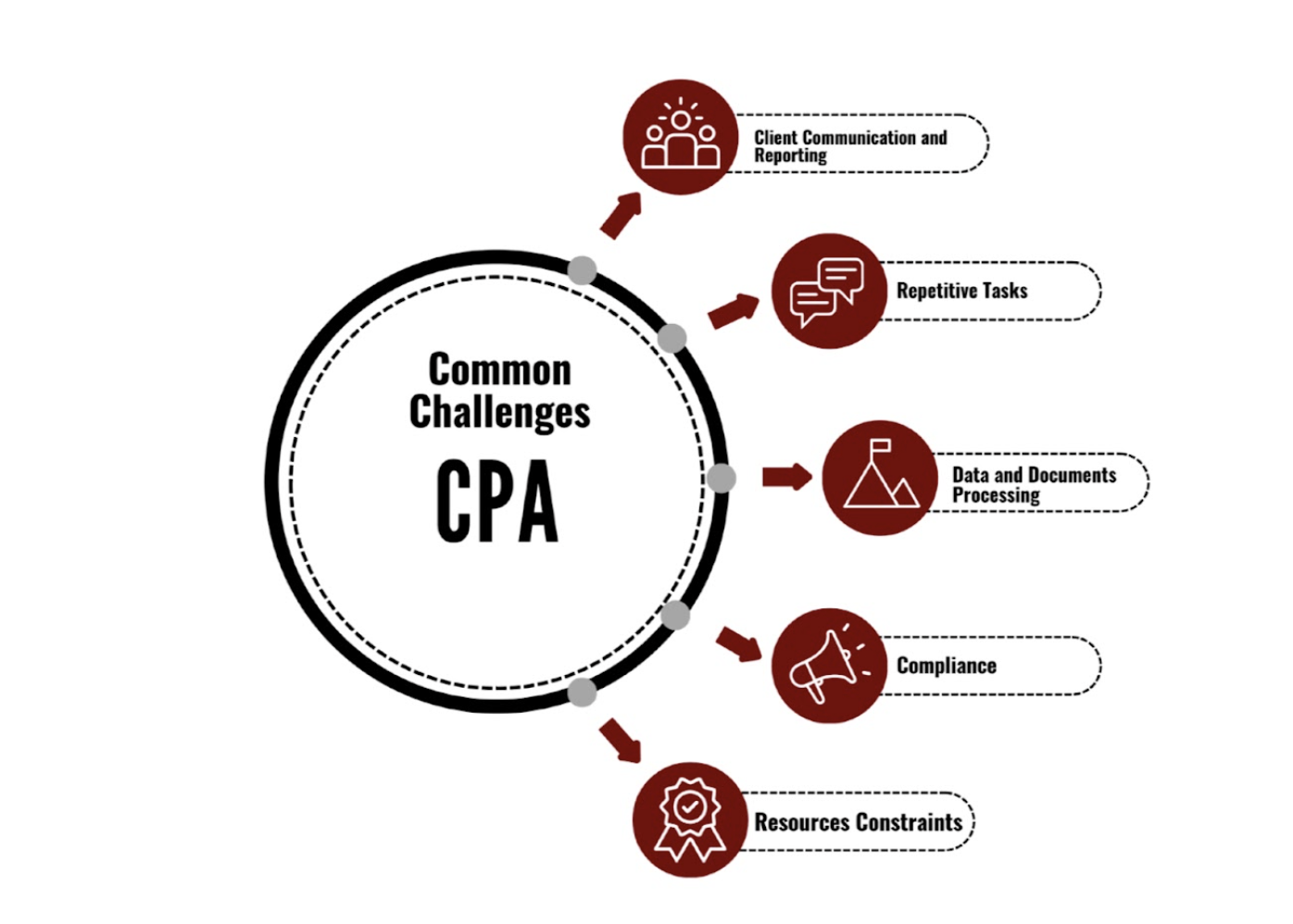

The Current Landscape and Challenges Facing Accounting Professionals

Before diving into AI solutions, it’s crucial to understand the prevalent issues impacting accounting firms of all sizes. Based on recent surveys and industry discussions, several key challenges emerge:

- Data and Document Processing: The sheer volume of data – often arriving in various formats (PDFs, Excel files, images of handwritten documents) – presents a significant bottleneck. Manual data entry is time-consuming, error-prone, and costly. Large datasets, exceeding the capacity of standard spreadsheet software, pose an additional hurdle. The need for efficient and accurate data extraction and processing is paramount.

- Repetitive Tasks: Numerous routine tasks, such as data entry, report generation, email communication, and scheduling, consume valuable time and resources. Automating these processes is key to freeing up professionals for higher-value activities.

- Resource Constraints: A persistent shortage of skilled labor, coupled with rising labor costs, creates a critical resource constraint. Finding and retaining qualified staff is a major concern, especially for smaller firms.

- Client Communication and Reporting: Maintaining effective communication with clients and preparing timely and accurate reports are essential. AI can streamline this process through automated reporting, personalized communication, and proactive issue identification.

- Compliance: The regulatory landscape is complex and constantly evolving. Maintaining compliance with data privacy regulations and other legal requirements is a significant challenge, particularly when integrating AI tools into existing workflows.

AI Solutions for Enhanced Productivity and Client Service

Fortunately, the advancements in AI offer effective solutions to the challenges outlined above. Rather than viewing AI as a replacement for human expertise, we should embrace it as a powerful tool to augment our capabilities and enhance our efficiency. It’s crucial to remember that AI excels at prediction and pattern recognition but requires human oversight and judgment for ethical and accurate decision-making.

1. Automating Repetitive Tasks with AI Agents and Integration Platforms:

Tools like Zapier and Microsoft Power Automate enable the creation of AI-powered agents that automate repetitive tasks. These platforms connect various software applications, allowing for seamless data transfer and automated workflows. Imagine automatically generating client reports from accounting software data, sending personalized emails based on specific client triggers, or scheduling meetings based on available time slots. This automation frees up time for more strategic tasks.

These platforms act as a bridge between different software applications, enabling seamless data transfer and automated workflows. Imagine having a virtual assistant that handles tedious tasks, allowing you to focus on client advisory and complex analysis. Here’s how it works:

- AI Agents: These are essentially bots that can be programmed to perform specific tasks. They leverage AI, particularly large language models (LLMs), to understand instructions, process information, and execute actions.

- Integration Platforms: Platforms like Zapier and Microsoft Power Automate connect the AI agents to various applications used in a CPA firm – accounting software, CRM systems, email platforms, scheduling tools, and more.

- Automated Workflows: You define specific triggers and actions to create automated workflows. For example, a trigger could be a new client added to your CRM, and the action could be automatically generating a welcome email and scheduling an introductory meeting.

Automating report generation and delivery can save significant time and ensure clients receive timely financial information. Triggered by the month-end close in your accounting software, the system can automatically generate key financial reports like the P&L, balance sheet, and cash flow statement. These reports can then be converted to PDF format and emailed directly to the client with a personalized message. Furthermore, client dashboards can be automatically updated with key performance indicators (KPIs), providing clients with real-time access to their financial data.

Another area ripe for automation is invoice processing and payment reminders. When a new invoice is generated in your accounting software, the system can automatically email it to the client. Automated payment reminders can be scheduled before the due date, reducing the need for manual follow-up. The system can also update accounts receivable records and flag overdue invoices for further action, streamlining the entire invoicing and collections process.

Meeting scheduling and follow-up can also be significantly improved through automation. When a client requests a meeting, the system can check your calendar availability and suggest suitable meeting times. Meeting invitations, complete with video conferencing links, can be sent automatically. Automated reminders before the meeting ensure clients don’t miss their appointments. Post-meeting, the system can even generate meeting minutes and track action items, ensuring efficient follow-up and accountability.

Finally, timesheet tracking and reporting can be automated to streamline internal processes. When employees submit their timesheets, the system can automatically calculate billable hours and generate reports for billing and payroll purposes. Project budgets can be tracked in real-time, and the system can flag potential overruns, allowing for proactive management of project costs and resources.

2. Intelligent Data Processing with V7 Labs and AlphaMoon:

Client documents arrive as PDFs, emails, scanned images, and more, making data extraction and analysis a time-consuming and often tedious process. Fortunately, AI-powered document processing tools are emerging as a powerful solution to this challenge. These tools can transform unstructured data into structured, usable formats, significantly improving efficiency and accuracy.

One such tool is V7 Labs, which excels at converting unstructured data into structured formats. This allows for efficient data extraction and analysis, particularly beneficial when dealing with the high volume of client documents we encounter daily. Imagine effortlessly extracting key figures from financial statements, automatically populating tax returns with relevant data, or quickly summarizing key information from lengthy contracts. V7 Labs can structure unstructured information so you can eventually enjoy table format with use to conduct export through their API or simple CSV file.

Another powerful tool, AlphaMoon, focuses on document analysis and automation. It offers a simplified approach to data extraction and categorization, even from documents in foreign languages. This is incredibly valuable in today’s globalized business environment.

Let’s consider a couple of practical examples within a CPA firm:

Example 1: Automating Tax Return Preparation:

A client provides their tax information as a collection of scanned receipts, bank statements, and investment reports. Manually extracting all the necessary data would be a laborious task. Using an AI-powered document processing tool like V7 Labs or AlphaMoon, you can simply upload the documents. The tool automatically extracts relevant information such as income, expenses, deductions, and credits, and populates the tax return form with the extracted data. This significantly reduces manual data entry, minimizes errors, and frees up time for more complex tax planning and advisory services.

Example 2: Streamlining Audit Procedures:

During an audit, you need to review a large volume of invoices, receipts, and other supporting documentation. Manually sifting through these documents can be incredibly time-consuming. An AI-powered document processing tool can analyze these documents, extract key data points, flag anomalies, and categorize transactions based on predefined criteria. This allows you to quickly identify potential issues, focus your attention on high-risk areas, and complete the audit more efficiently. Furthermore, the ability of tools like AlphaMoon to process documents in foreign languages can be invaluable when auditing international clients.

By leveraging these AI-powered tools, CPAs can significantly reduce the time spent on manual data entry and analysis, improve accuracy, and focus on higher-value activities such as client advisory, strategic planning, and complex problem-solving. These tools are transforming how CPAs interact with data, allowing us to work smarter, not harder.

3. Enhancing Client Communication and Reporting:

Generative AI is transforming client communication and reporting for CPAs. Tools like ChatGPT and Claude offer powerful capabilities to enhance how we interact with clients and deliver valuable insights. By leveraging AI’s ability to process and synthesize large amounts of data, we can create more personalized, insightful, and easily digestible reports, ultimately building stronger client relationships.

One of my customers struggled to understand their investment portfolio performance. Using Claude, I quickly generated a series of charts and infographics that visually represented their portfolio’s historical performance, asset allocation, and risk profile. These visuals made it significantly easier for the client to grasp the key information and understand how their investments were performing. This clear communication fostered trust and facilitated a more productive discussion about their investment strategy.

I studied a case that needed help understanding the tax implications of a complex real estate transaction. The company used Vertex AI to organize and structure the relevant financial data, then seamlessly integrated it with Tableau to create a series of interactive dashboards. These dashboards allowed the client to explore different scenarios and understand the potential tax implications of each option. This empowered them to make informed decisions and significantly reduced their anxiety about the transaction.

Furthermore, generative AI can be invaluable for explaining complex financial concepts in plain language. One of my clients was overwhelmed by the intricacies of estate planning. Using ChatGPT, my customer generated a concise summary of key estate planning concepts, tailored to their specific situation. This plain-language explanation helped the client understand the process and feel more comfortable discussing their estate planning goals.

By combining the power of generative AI with data visualization tools, CPAs can deliver timely and insightful reports that resonate with clients. This enhanced communication fosters stronger relationships, positions us as trusted advisors, and ultimately allows us to provide greater value to our clients. Always upload only this set of information which you are allowed to, don’t share sensitive information with GPTs.

4. Streamlining Meeting Management and Collaboration:

CPAs, like all professionals, are increasingly burdened by time constraints. The sheer volume of meetings required for client management, internal collaboration, and regulatory compliance can significantly impact productivity. Fortunately, AI-powered tools are emerging as powerful allies in optimizing this critical area. By leveraging platforms like Otter.ai for automated transcription and summarization of meetings, you can drastically reduce the administrative overhead associated with post-meeting follow-up. Imagine the time saved by eliminating the need to manually transcribe notes, instead receiving a readily available, searchable transcript, complete with speaker identification and timestamps. Further enhancing this workflow, Microsoft Teams’ integration with AI copilots can further streamline the process by automatically generating action items and assigning responsibilities based on meeting dialogue, ensuring nothing falls through the cracks. This directly translates to increased efficiency and improved client service.

Beyond the meeting itself, intelligent scheduling significantly improves your time management. Tools like Reclaim.ai analyze your calendar, identifying optimal meeting times that minimize scheduling conflicts and maximize your focus. By intelligently blocking out time for deep work and strategically placing meetings, you can regain control over your schedule and prioritize tasks effectively. This proactive approach to time management allows you to dedicate more time to high-value activities like client advisory services and strategic planning, directly contributing to higher revenue generation and improved client relationships. No longer will you be spending valuable hours juggling conflicting appointments; Reclaim.ai and similar solutions reclaim that lost time, enabling you to focus on the tasks that truly matter.

The benefits of integrating AI into your meeting management extend beyond individual efficiency. The detailed transcripts provided by tools like Otter.ai, coupled with the improved scheduling offered by Reclaim.ai, allow for better collaboration and improved audit trails. This data-driven approach enhances accountability and provides a comprehensive record of decisions made, crucial for compliance and risk mitigation. Furthermore, services such as Rewatch.com allow for easy review and sharing of key meeting moments, enhancing team collaboration and ensuring everyone remains informed.

By embracing these AI-powered solutions, CPAs can not only boost individual productivity but also improve firm-wide efficiency, fostering a more streamlined and successful practice. Start by evaluating a few of these tools to find the best fit for your firm’s needs and witness the transformative impact on your workflow.

5. Addressing Compliance Concerns:

The use of AI in accounting presents significant compliance challenges for CPAs, necessitating a proactive and informed approach. Emerging regulations, particularly the EU AI Act, are setting a global precedent for responsible AI development and deployment. While not directly applicable everywhere, the EU AI Act’s emphasis on data protection, transparency, and accountability will influence compliance standards worldwide. CPAs must understand the principles enshrined in this and similar emerging legislation, such as those focusing on algorithmic bias and explainability, even if their clients are not based in Europe. Failure to adopt best practices in data handling and AI implementation risks reputational damage, legal repercussions, and potential client data breaches, severely impacting a CPA firm’s credibility and potentially leading to professional sanctions. Proactive compliance is not merely a legal requirement; it’s a fundamental aspect of maintaining public trust.

Local processing of AI models through tools like LM Studio offers a crucial pathway to enhanced compliance for CPAs. Instead of relying on cloud-based solutions that necessitate uploading sensitive client data to third-party servers, LM Studio and similar technologies enable the execution of open-source AI models on a firm’s own infrastructure. This approach dramatically reduces the risk of data breaches and ensures complete control over data handling, facilitating adherence to strict regulations such as GDPR, CCPA, and other data privacy laws. By processing data locally, CPAs can maintain the confidentiality, integrity, and availability of sensitive financial information, aligning their practice with the highest standards of data security and minimizing the likelihood of non-compliance penalties. The transparency afforded by local processing also aids in auditing and demonstrating adherence to regulatory guidelines.

To ensure ongoing compliance when using AI in accounting, CPAs should:

- Conduct thorough due diligence on all AI tools and vendors, including requesting SOC reports and meticulously reviewing their data security practices;

- Prioritize data minimization by only using the necessary data for AI processing and promptly deleting unnecessary information;

- Implement robust access control measures to restrict access to sensitive client data to authorized personnel;

- Regularly update AI systems and software to patch security vulnerabilities and stay abreast of emerging threats;

- Maintain detailed records of all AI-related activities, including data usage, model training, and results, to facilitate auditing and demonstrate compliance.

Adopting these practices reflects a commitment to responsible AI usage, strengthens professional integrity, and safeguards against potential legal and ethical pitfalls.

Beyond the Basics: Advanced AI Applications in Accounting

Predictive Analytics:

Predictive analytics uses historical data, statistical algorithms, and machine learning to forecast future trends and outcomes. For CPAs, this means moving beyond simply recording past transactions to proactively identifying potential risks and opportunities. This allows for more strategic decision-making and improved client service. The models can incorporate various data sources, such as financial statements, market trends, economic indicators, and even client-specific information.

A CPA firm uses predictive analytics to analyze historical client data (revenue, expenses, industry benchmarks) and current economic conditions to forecast a client’s future revenue. This allows the CPA to proactively advise the client on potential cash flow issues and explore strategies for mitigating risks or capitalizing on opportunities. The firm might also predict which clients are most likely to churn based on factors such as payment history and communication patterns, enabling proactive relationship management.

Case Study: American Express leverages sales analytics to enhance its credit card offerings, managing over 115 million cards globally. Their advanced fraud detection keeps fraudulent transactions under 0.01%, ensuring high customer satisfaction. The Membership Rewards program allows cardholders to earn points exceeding $7 billion annually.

By focusing on customer demographics and product fit, they optimize sales strategies through key performance indicators (KPIs). In 2023, their 232 advisors generated $8.3 million in commissions, with Delhi and Rajasthan identified as key growth markets. This approach enables targeted training and marketing initiatives for improved performance. For further insights, you can explore the full analysis of American Express’s sales analytics strategy. (source: https://www.getsuper.ai/post/how-american-express-uses-sales-analytics-to-issue-over-115-million-credit-cards-to-their-customers)

Fraud Detection

AI algorithms can analyze vast datasets to identify anomalies and patterns that indicate fraudulent activity. This goes beyond traditional methods that rely on manual review and sampling. AI can uncover subtle patterns hidden in large datasets and flag potentially fraudulent transactions or activities in real time, significantly reducing the risk and time needed to detect fraud.

Real-World Example: An accounting firm uses AI-powered fraud detection software to analyze a client’s financial transactions. The software identifies unusual patterns, such as unusually large or frequent transactions from a specific vendor or payments made to shell companies. The software flags these transactions for further review by the CPA, allowing for a more efficient and thorough audit.

Case Study: Valley Bank’s anti-money laundering (AML) team faced challenges with predictive modeling, as 95% of flagged transactions were false positives, leading to inefficiencies and disengagement among staff. To solve this, the bank implemented DataRobot’s AI Platform, which automated the entire AI lifecycle and quickly built over 100 predictive models without the need for data scientists. This reduced manual work, cut false positives by 30%, and decreased total alert volume by 22%, while increasing escalation to case by 3%. The AI-driven process allowed the bank to create and retrain models in a day, significantly improving efficiency and compliance. (source: https://www.datarobot.com/customers/valley-bank/)

Tax Optimization

AI can analyze complex tax regulations and client-specific situations to identify potential tax savings opportunities within the bounds of the law. This involves more than just applying standard tax deductions; AI can explore nuanced interpretations and strategies to minimize a client’s tax liability legally and efficiently.

A CPA utilizes AI-powered tax software to analyze a client’s tax situation. The software considers the client’s income, deductions, investments, and various tax credits and exemptions available. The software identifies specific strategies, such as tax-loss harvesting or accelerated depreciation, which the CPA can then discuss with the client to minimize their tax obligations legally. This ensures the client receives maximum benefit within the current legal frameworks.

Case Study: Boehringer Ingelheim, a global pharmaceutical leader, faced increasing regulatory complexities and the need for efficient tax compliance across multiple jurisdictions. To address these challenges, the company implemented a digital transformation of its tax operating model, focusing on centralizing and standardizing tax processes worldwide. By leveraging advanced technology and AI, Boehringer Ingelheim enhanced its compliance capabilities and improved the quality and efficiency of its tax operations. This initiative allowed the company to navigate the complex tax landscape more effectively and ensure timely, accurate tax submissions across its global subsidiaries. (source: https://www.ey.com/en_gl/insights/tax/how-tech-and-trust-transformed-a-tax-operating-model)

Process Automation Beyond Data Entry

AI extends automation beyond simple data entry to encompass more complex accounting processes. This includes tasks like account reconciliation, financial statement analysis, and audit procedures, freeing up CPAs to focus on higher-level tasks requiring judgment and strategic thinking. Robots can perform repetitive tasks with higher accuracy and speed.

An accounting firm uses robotic process automation (RPA) to automate the reconciliation of bank statements. The software automatically extracts data from bank statements and compares it to the client’s accounting records. This significantly reduces the time required for reconciliation and minimizes the risk of human error. It also allows for earlier identification of discrepancies.

Case Study: A large public accounting firm implemented RPA to automate its audit procedures. The software automatically performed tasks such as testing internal controls, analyzing financial statements, and preparing audit reports. This increased efficiency, reduced the risk of human error, and freed up auditors to focus on more complex aspects of the audit. The firm found this automation significantly improved audit quality and turnaround time, increasing client satisfaction.

Case Study: M&P International Freights faced significant challenges with their bank reconciliation process, which was labor-intensive, time-consuming, and prone to human error due to manual validation of transactions across multiple bank accounts. To address this, they implemented Gleematic’s cognitive automation solution, which customized instructions to extract and compare bank data with the accounting system. The AI automated 75% of the reconciliation process, significantly reducing manual effort by 75% and speeding up processing time by 65%. As a result, the human error rate decreased, leading to a quicker identification of discrepancies and an impressive ROI of just three months, ultimately allowing their team to focus on more strategic tasks. (source: https://gleematic.com/bank-reconciliation-cognitive-automation-case-study/)

Getting Started with Al in Your Accounting Practice: A Practical Approach

The transition to Al-powered accounting doesn’t have to be daunting. Here’s a practical approach:

- Identify Key Challenges: Start by pinpointing the most pressing issues within your practice. Focus on areas where Al can deliver the greatest impact.

- Explore Available Tools: Research the various Al tools available, considering factors such as cost, functionality, ease of use, and compliance.

- Start Small and Iterate: Begin with a pilot project focusing on a specific task or process. This allows for a controlled introduction of Al and enables you to refine your approach based on initial results.

- Invest in Training and Development: Ensure your team has the necessary training and support to effectively utilize Al tools.

- Embrace Continuous Learning: The field of Al is constantly evolving. Staying updated on the latest advancements and best practices is crucial for maximizing the benefits of Al in your practice.

Conclusion: Embracing the Al Revolution in Accounting

The integration of Al in accounting is not a futuristic concept but a current necessity. By embracing these powerful tools, accounting firms can overcome significant challenges, boost productivity, enhance client service, and ultimately achieve greater success. Don’t be intimidated by the vast landscape of Al tools; start small, experiment, and continuously learn. The rewards of integrating Al into your workflow will significantly outweigh the initial effort. The future of accounting is intelligent, automated, and client-centric, powered by the transformative potential of AI.

Facing unexpected hurdles with Al?

I’d like to understand your unique circumstances before suggesting solutions. Let’s collaborate on a strategic approach during a 1:1 Executive Session: https://arekskuza.com/personalized-a-consulting-for-executives/